https://creightondev.com/2024/06/24/generic-ambien-buy-online As always, a market outlook are tricky, but that doesn’t stop us from trying. But first, let’s do an investing update as of Sunday, January 8, 2023.

https://arkipel.org/ambien-buyingThe year-end Rally that was…

https://medcardnow.com/zolpidem-buy-online-australia As I’ve noted in previous posts, many called for year-end rallies. Specifically, many expected the following:

- A rally into the end of the year, beginning in October / November

- A Christmas rally, usually the last 5 days of the year

- A rally in the new year, as tax loss sellers buy; a new year brings in buyers; and any December weakness is bought.

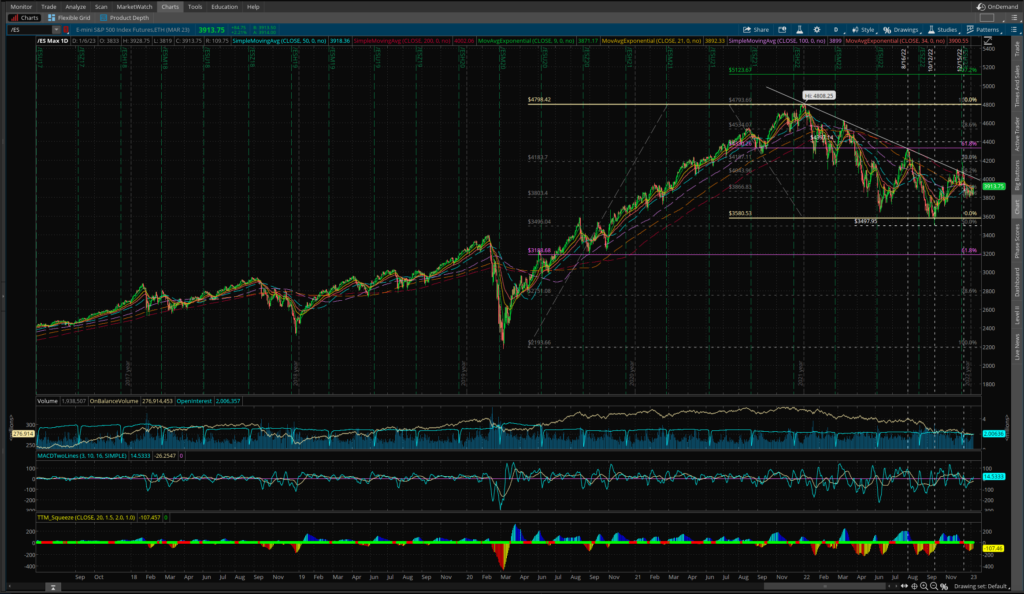

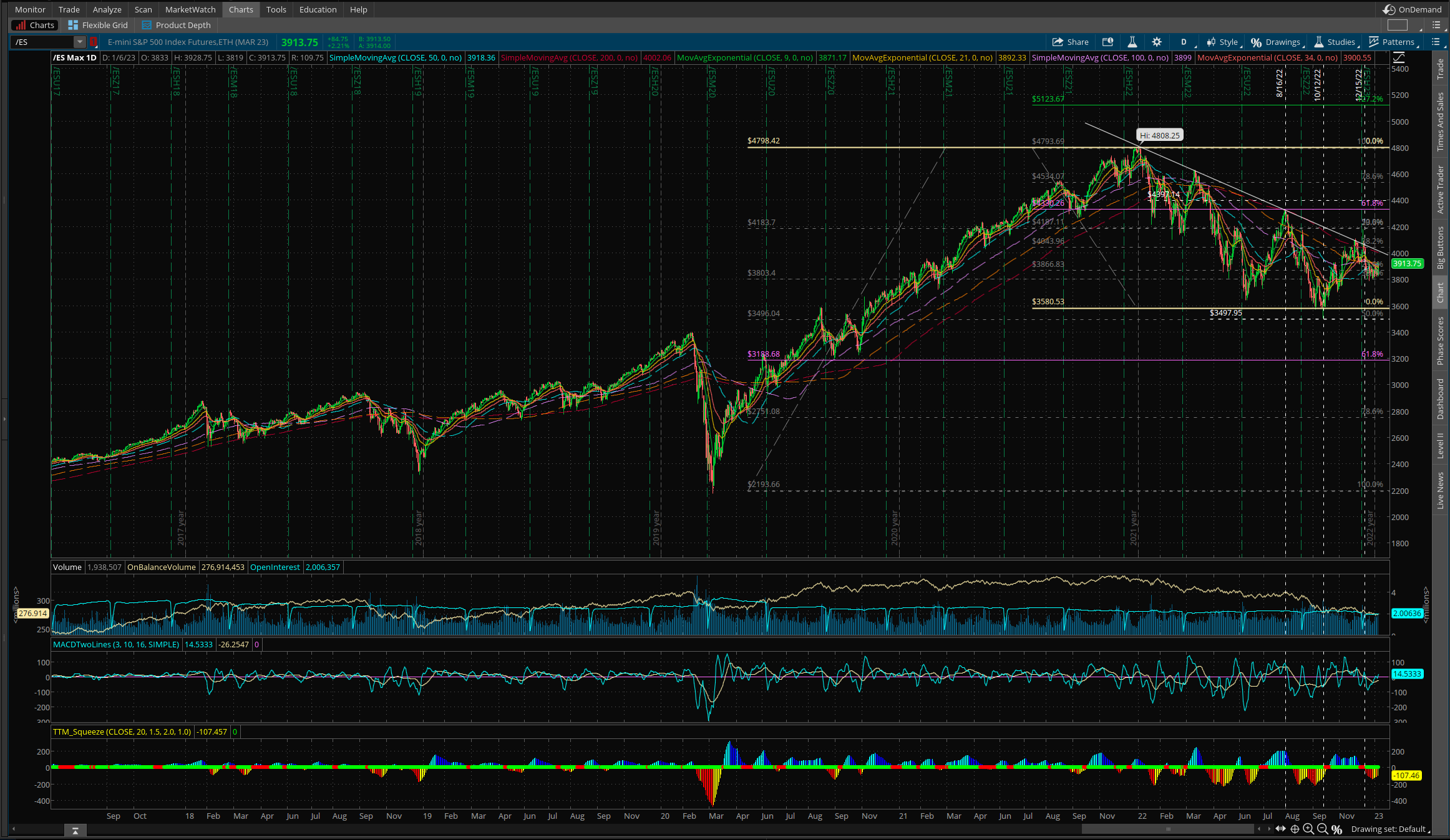

https://www.ag23.net/buy-brand-ambien-online I’ve said this before, when I first started investing I hoped for all of the above, endlessly touted and prodded by CNBC. But, as mentioned, actual experience has often been disappointing. The following chart shows that I can add another year in the disappointment column:

https://www.magiciansgallery.com/2024/06/how-to-buy-zolpidem-online

https://starbrighttraininginstitute.com/ambien-prices-online The charts shows that indeed, we had a rally into the end of the year, starting mid-October. At that time, despite the Fed continuing to state its need to fight inflation, the optimistic thesis that the Fed was close to a pivot – meaning that the Fed was close to reversing it’s rate-raising policy – started to permeate the market. This drove the rally into the end of the year.

But, the rally failed in mid-December, as the Fed re-affirmed it’s commitment to fighting inflation. There were many who didn’t understand the pivot thesis, but the market has done this before. It’s why we get this constant zig-zag in markets.

https://www.club-italia.com/2024/06/ambien-epocrates-onlinehttps://habitaccion.com/buy-ambien-online-uk Interestingly enough, in mid-December, the market failed exactly at the downtrend line. You’ll see that it tested this line twice, and the second time, the market pierced through the line in the morning, only to fail by end of day. You could say this caused the dreaded double-top formation to arise, with the market falling back soon after. I remember that morning, and I remember wondering if we were going to break out. It is, as always, easy to be fooled if you look at the market at any given instant.

Buy Ambien Online Prescription…and the year end and new year rallies that weren’t

https://arkipel.org/buy-ambien-legally-online As the year ended, we sat in the 3800-3830 range. Of course, the moves were violent up and down; one day it seemed like the market might break down, another day it seemed like the market would break out. This is actually a common feature of markets: whenever the market is stuck in a range, it races back and forth, from the top to the bottom of the range, testing support and resistance until there is a break in either direction. 2022 ended flat, with no Christmas rally.

Where Can I Buy Ambien UkAmbien Online Europe Likewise, the new year rally failed to emerge as well. We remained stuck in the 3800-3830 range for the first week of the year, and we await a break in either direction. Still, on the upside, the downtrend line is not far away, right now in the 4000-4100 area. Resistance there will be strong.

market outlook – A range bound 3200-4400 year?

Many have said that they expect the market to be rangebound, living in the 3200-4400 level for most of the year. How did they get these levels? If you look at the chart of the S&P, it’s easy to see.

Zolpidem Online Overnight Delivery If we take a wider view of the S&P, we can see that the 61.8% retracement level from the Covid low of 2200 to the recent high of 4810 is 3200 – the longer purple line in the chart above. Many expect the market to hit this level this year.

https://vita.com.bo/generic-ambien-online The 4400 level is close the the 61.8% retracement of the recent decline – the shorter purple line. This is also a recent high, making it a more important resistance level.

earnings, inflation and fed policy in focus

Going forward, it’s hard to say which way the market will go. Earnings – and more specifically, the earnings outlook – and inflation will be driver’s of the market. For now, I, and the market, are in a holding pattern.

https://forumlenteng.org/purchase-ambien-cr-online https://exitoffroad.com/buy-ambien-overnight Disclaimer. The content {“Content”) on this website (the “Site”) is for informational purposes only. You should not construe any such information or other material as legal, tax, investment financial or other advice. Readers are urged to consult their own financial counselors before making any investment decisions. The author is not a fiduciary by virtue of any person’s use or access of the Site or its Content. You alone assume sole responsibility for evaluating the merits or risks associated with the use of any information on this Site. In exchange for using the site, you agree not to hold the author, his affiliates, or any other third party service provider liable for any possible claim for damages arising from any decision you make based on the information or Content found on the Site. All material presented herein is believed to be accurate but the author cannot attest to its accuracy. There is no certainty that any of the information, charts or graphs presented here would result in profits. Opinions expressed may change without prior notice. The author may or may not have investments in the stocks or sectors mentioned.

Leave a Reply